Whilst the horror of the war in Ukraine continues and the plight of the Ukrainian people is plain for all to see, what is also slowly emerging is the domestic impact of Ukraine’s economy grinding to a halt and the knock-on effect of sanctions on Russia. The manufacturing industry faces challenging times ahead with price increases, shortages of raw materials and supply chain issues.

Energy crisis

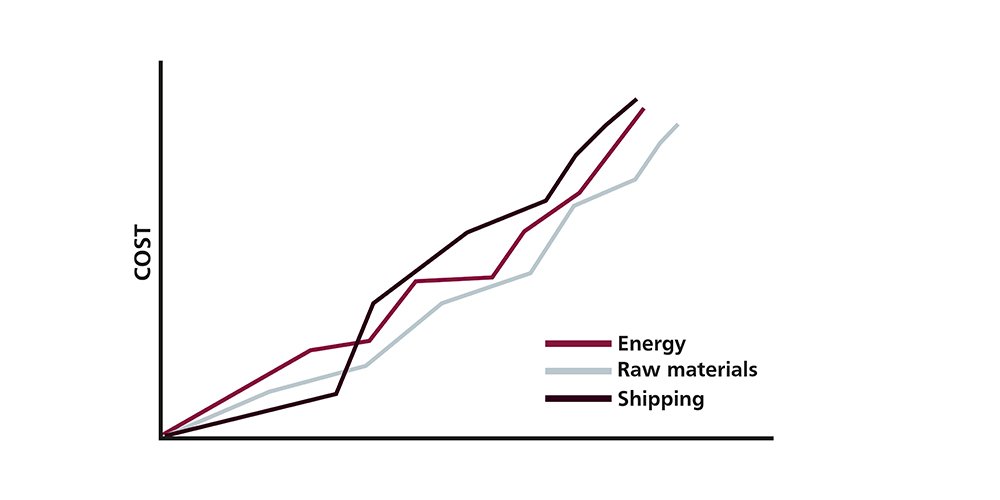

The energy crisis has been brewing for a while, but has been seriously exacerbated by Russia, which supplies Europe with a lot of its gas. Even before it invaded Ukraine, Russia was using Europe’s reliance on its gas supply for political gain. Although the UK does not source a lot of its gas from Russia, it sources a lot from Finland, and the gas crisis in the rest of Europe has simply forced prices up.

The effect is more far-reaching than simply increasing everyone’s energy bill. For example, gas prices have affected the production of glue and glue is an essential part of MDF. The price of MDF soared by 70% in 2021 and this rise is set to continue.

Gas is also used in large amounts for testing fire doors – imagine the consumption of a gas fired furnace roaring for over 60 minutes. The cost of those tests has increased significantly. Some testing laboratories have already written to their customers informing them of a 20% surcharge to cover these increased energy costs.

Raw materials shortages

Wood and wood products had already risen in price as a result of the post-lockdown building boom, but the war in Ukraine has added to that pressure.

Russia grows a large amount of high quality, FSC-certified softwood timber – it is slow growing, very compact and strong, and performs reliably in fire tests. However, the Government in Russia has close ties with the nation’s forestry industry, and the Forest Stewardship Council (FSC), has therefore suspended all trading certificates for controlled timber in Russia and Belarus until after the invasion is over. Those seeking to source similar certified timber elsewhere may look to Canada – another good source historically – but the post-pandemic construction boom means that Canada and other nations are holding onto their supplies and not exporting as much as they were.

Ukraine is a major supplier of veneer, providing 40-50% of European veneer. Stocks will run out soon and the equivalent veneer from Finland is 30-40% more expensive. The US also supplies a lot of veneer, but the industry relies on paying workers the minimum wage. Many such industries suffered from ‘the Amazon effect’ post Covid, when a lot of workers defected to Amazon for better pay and conditions. Oak veneered board is in some cases now more than double the price it was in 2021.

Shipping

The shipping crisis continues to rumble on. Container prices rose from £2k to a high of £19k in 2021 – prices have peaked hopefully and are on their way back down, but the UK ships in all of its veneer and board. According to our sources, some veneer purchased in the US in October last year has only just arrived in Liverpool because of severe delays and containers being backed up waiting for certification.

Conclusion

Whether the causes are environmental or political, the inevitable increase in costs must be at least partially passed on if door manufacturers are going to survive and continue to supply the construction industry with essential life-saving fire doors. Naturally, all of this is entirely secondary when we look at the suffering and loss of life in Ukraine – we can only hope for some sort of resolution soon so that Ukraine can start the long road to recovery and reconstruction.

Leave us your contact details and we will call you back for a free consultation about your requirements.